Understanding the relationship between political climates and both sector and Style Box performance is essential for advisors aiming to optimize client portfolios through various market cycles. This guide offers insights into how different political configurations impact sector and Style Box returns, covering the four major political scenarios: unified Republican control, unified Democratic control, and split Congress under either party.

Data Sources and Scope

This analysis spans 50 years, including multiple election cycles to offer a comprehensive perspective. Data sources include Morningstar, S&P Capital IQ, and Bloomberg, with historical average returns highlighting trends across sectors and Style Boxes based on political alignment.

1. Republican President and Congress

In periods where Republicans control both the presidency and Congress, sectors like defense, energy, and financial services often experience gains, which extend to particular Style Boxes as well:

Insights: Large-Cap and Mid-Cap Value segments tend to excel under Republican control, benefiting from stability within industrial, defense, and energy sectors. Small-Cap Value often strengthens as deregulation boosts regional industries.

2. Democratic President and Congress

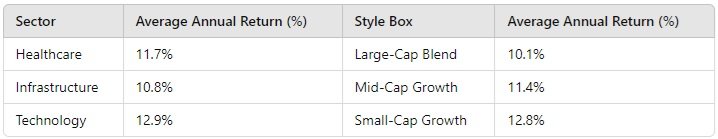

A Democratic administration with a Democratic Congress tends to emphasize sectors like healthcare, technology, and clean energy, driving growth-oriented Style Boxes.

Insights: Growth Style Boxes, particularly Mid-Cap and Small-Cap Growth, show strength due to increased government spending in sectors like healthcare, technology, and renewable energy, supporting returns in innovation-heavy categories.

3. Republican President with Mixed Congress

With a Republican president and mixed Congress, a balanced policy approach is more likely, favoring stable sectors such as utilities and real estate.

Insights: Value-oriented Style Boxes, especially Large-Cap Value, provide consistent returns due to a stable, moderate policy stance. Small-Cap Blend segments also see moderate growth as consumer spending and housing remain stable.

4. Democratic President with Mixed Congress

Under a Democratic president and divided Congress, focus remains on sectors like healthcare, infrastructure, and technology, favoring growth and blend Style Boxes.

Insights: Growth sectors fare well in this environment, with bipartisan support aligning with investments in healthcare, infrastructure, and technology. Small-Cap Growth benefits from innovation and infrastructure spending, while Mid-Cap Growth remains robust amid government support.

Key Takeaways for Advisors

Political Cycle-Based Diversification: Consider Value Style Boxes under Republican leadership and Growth-oriented Style Boxes with Democratic control, aligning portfolios with policy impacts.

Long-Term Sector Strategy: Use political insights to build resilience by allocating toward Value sectors in Republican periods and Growth sectors in Democratic cycles.

Data-Driven Guidance: While these patterns are historical, advisors should consider economic conditions and global influences in addition to political environments.

This analysis provides a robust foundation for aligning sector and Style Box allocations with political landscapes.

For advisors that prefer scenario-based rotational strategies, such insights can be integral to tailoring client portfolios.